Many people assume that they don’t have enough money to become an investor. But there’s no need to wait until you’re rich. Quite the contrary, starting small is one of the smartest steps you can take to reach your financial goals.

Everyone can start to invest at almost any point. Thanks to the digitalisation of private banking methods, it’s now possible to invest in ways that were once only available to the wealthy.

As many people are unsure how to invest small amounts of money, we created this article to show you how you can cost-effectively invest your savings online. You can get started with CHF 2,000, or even as little as CHF 100!

What are the best investment ideas for small investors?

Saving money in your bank account and contributing to pension schemes is a great start. But consider the following questions: Will the pension cover the lifestyle you’re aiming for in retirement? And how many millionaires got rich keeping their money in a bank account?

The problem is that in a Swiss bank account, your money will earn around 0.01% interest. This means that a CHF 5,000 balance increases by less than CHF 1 per year (we cover this topic in our article The Smart Alternative to Swiss Savings Accounts). What’s more, inflation is now on an upward swing in Switzerland, meaning that the price of goods and services is slowly increasing (for instance, in 2001 a BigMac cost CHF 5.90, whereas now it costs CHF 6.50). This means that the money in your bank account loses value over time.

What’s the best way to invest small amounts of money?

The stock market is generally a good balance between risk and return as long as you intend to hold onto your investment for at least five years. That’s because although the market moves up and down constantly, it’s always moved in an upward direction in the long term.

Sure, stock market investments are riskier than leaving your cash in a bank account, but they also offer a much higher potential return (historically 6% per year on average — even including all the big downturns, such as the Global Financial Crisis in 2008). So if your goal is to increase your wealth over time, the stock market is an excellent option for investing small amounts of money.

Advantages of stock market investing for smaller investors

Good returns

Average growth around 6% per year, compared to 0.01% interest if you keep the money in your bank account.

Risk management

Your portfolio can be optimised to the level of risk that’s appropriate for you.

Customisation

Invest in companies that are in line with your values — it’s possible to create a positive impact on the world without sacrificing returns. Note: this customisation isn’t possible if you choose to invest through funds or ETFs.

Liquidity

You should typically only invest in stocks if you intend to hold your investment for a long period of time. But if you need your money because of unforeseen circumstances, it will generally be back in your account within seven business days.

6 steps for investing small amounts of money

Step 1: Figure out the basics

How much money do you need to invest in stocks? We recommend at least CHF 2,000.

While it is possible to invest with less, this is the amount you need to diversify your investment properly — i.e. buying a range of different company stocks in various industries and countries.

When you invest small amounts of money, it might be tempting to put everything into one or two companies. This is a rookie mistake!

Let’s say you only buy Apple shares. If a crisis hits that company, your investment will be in trouble. The same applies if you buy a range of different company stocks within the same industry (remember the dot-com bubble?).

With CHF 2,000, you can comfortably buy stocks of 30-40 companies and spread your risk across a range of different factors.

Don’t have CHF 2,000 to invest?

At Inyova, you can get started with CHF 100 if you set up a savings plan that automatically contributes to your investment account each month. Once it hits CHF 2,000, we invest the money for you. This approach is what we recommend as the best way to invest small amounts of money under CHF 2,000.

Step 2: Consider your risk profile

Risk can be carefully managed if you apply a long-term view of investing in the stock market. Our investment experts recommend a five-point approach to risk management.

- Think about your capacity and appetite for risk.

- Diversification is important. As mentioned before, don’t put all your eggs in one basket.

- Balance stocks with less volatile assets, such as bonds.

- Regularly rebalance your portfolio (read more on what rebalancing is).

- Have an outlook of holding onto your investment for five years or more.

N.B. The last point is important. The stock market has good years, and it has bad years, which means that there is never a guarantee that you will make a profit in five years. Investing without any risk at all is not possible. But generally speaking, the market has always moved in an upward direction over time — the longer you hold onto your investment, the more likely you are to have an attractive return on your investment. This is true regardless of whether you invest small amounts or large amounts.

Step 3: Choose your stocks

Which companies should you invest in? It might be tempting to try and pick the ‘next big thing’. But since no one can predict the future, trying to pick ‘winning’ stocks is almost always a losing strategy.

In fact, it’s not much more effective than throwing darts with your eyes closed. Instead, we recommend choosing a range of different stocks that are in line with your values. This is your big chance to have real ownership in companies that share your vision for the world.

Whether you have a four or a seven-figure amount to invest, research shows that impact investing does not mean sacrificing returns. Read more about it here.

In the past, impact investing required you to do a lot of research yourself, and you needed access to closely-guarded information that wasn’t publicly available.

We’ve made this much more accessible. By streamlining the investing process into an easy online tool (try it here — free and non-binding!), it is now possible for you to participate in one of the best ways to invest small amounts of money — while still making a positive impact!

Here’s a taste of what topics your Inyova strategy can be built around:

| Handprint Topics | ||||||

|---|---|---|---|---|---|---|

| Renewable Energy | Energy-saving Technology | Clean Water | Circular Economy | |||

| Sustainable Forestry | Plant-based Food | Access to Medicine | Disease Eradication | |||

| Digital Champions | Transport of the Future | Swiss Champions | Advancing Education | |||

| Footprint Topics | ||||||

|---|---|---|---|---|---|---|

| Low Carbon Emissions | Gender Equality | Fair Pay | Human Rights | |||

| Exclusion Criteria | ||||||

|---|---|---|---|---|---|---|

| No Coal or Gas | No Nuclear | No Pesticides | No Alcohol | |||

| No Tobacco | No Meat | No Animal Testing | No Weapons | |||

Step 4: Buy your stocks (avoid hidden fees!)

Many people invest in managed funds or ETFs because they believe that this is the only way to participate in the stock market with a small investment amount.

And yes, transaction fees can make investing expensive.

Even if you use a low-cost ‘do it yourself’ provider such as SwissQuote, a well-diversified investment will attract around CHF 520 in transaction fees when you invest. That’s a massive loss to deal with on day one!

Fees of each stock transaction

| Swiss Stocks | European Stocks | America | ||||

|---|---|---|---|---|---|---|

| SwissQuote | CHF 9 | EUR 25 | USD 15 | |||

| Inyova | 0 | 0 | 0 |

With that in mind, it’s easy to see why funds and ETFs seem like a cost-effective alternative.

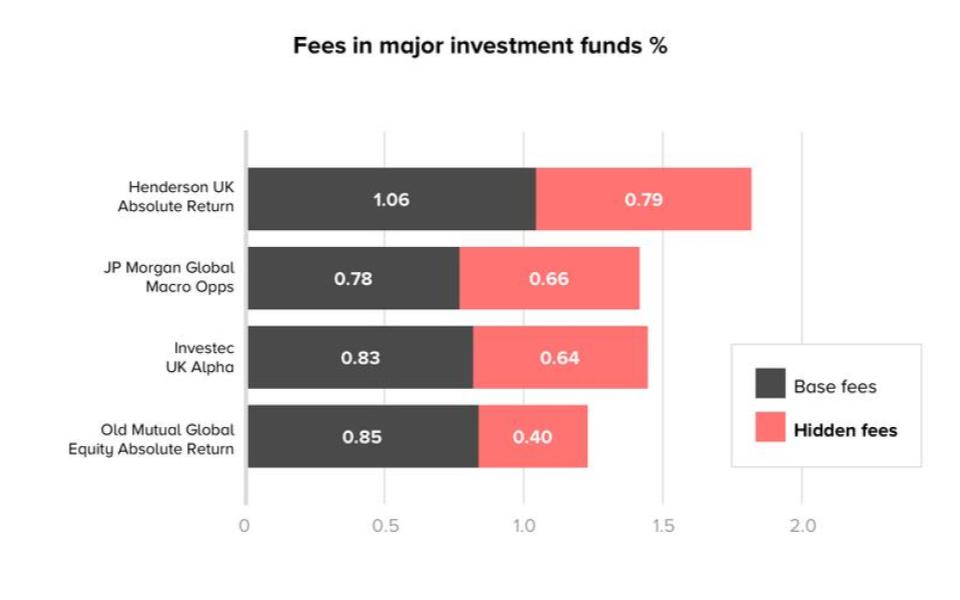

Unfortunately, these solutions come with their own drawbacks (we detail these in our article ETFs: What you need to know). A Financial Times investigation also found that several major funds cost more than four times of what people think, due to complicated cost structures.

Source: Financial Times

Step 5: Set up an automatic reinvestment

Assuming you don’t have to pay transaction fees, one of the easiest and most rewarding ways to grow your savings is to set up an automatic payment that regularly adds to your investment.

Let’s say you add CHF 100 each month. In Switzerland, that’s the price of a meal out.

As countless behavioural psychologists have noted, you won’t miss that money. Since it automatically moves to your investment account, you never experience the negative emotions around ‘giving it up’.

Instead, you get extremely positive emotions when your wealth grows substantially.

Assuming the average annual stock market return of 6%, even a small investment in the stock market will double approximately every 12 years.

To be exact, your monthly contribution of CHF 100 will grow to:

- CHF 6,949 in 5 years

- CHF 16,247 in 10 years

- CHF 45,344 in 20 years

Most importantly, you will only pay CHF 24,000 out of your own pocket (and spread over 20 years, so you won’t even notice it leaving). The remaining CHF 21,344 is pure profit. Contributing a certain amount of your income each month has another huge advantage — it effectively balances your exposure to the volatility of the market. By investing in stocks regularly and buying them regardless of the economic situation, you achieve more stable and continuous growth, which makes this a great way to invest small amounts!

Step 6: Don’t do anything!

We are big fans of the ‘buy and hold’ approach to investing. This is where you establish a well-diversified portfolio of stocks and stick with this same investment strategy over time.

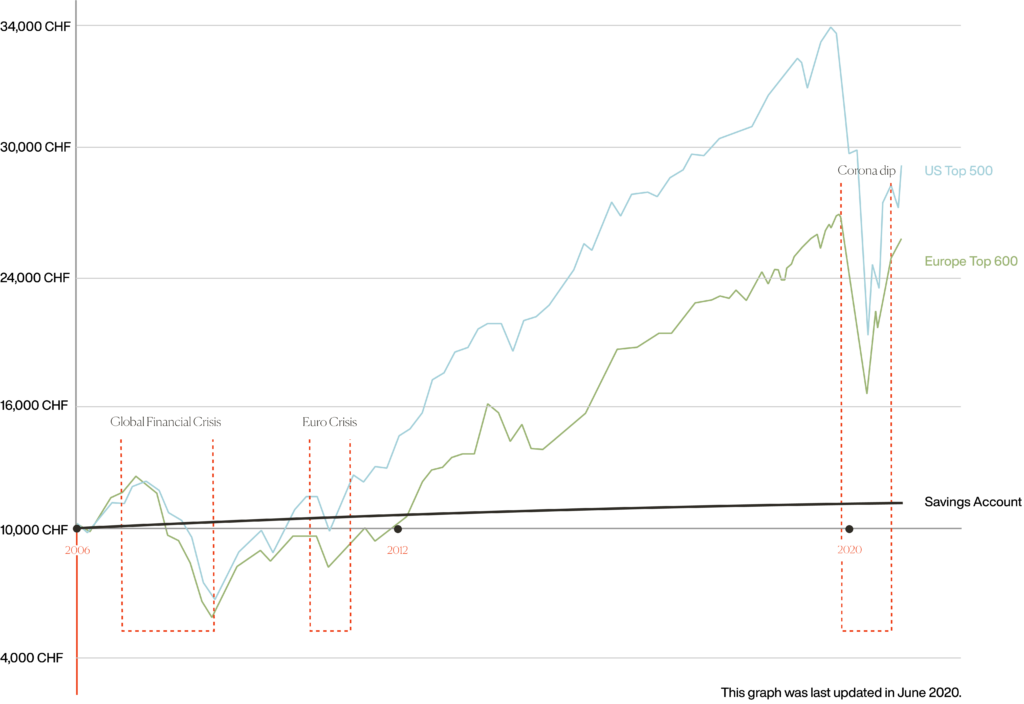

As investment magnate Warren Buffett famously said: “My favourite holding period is forever.” This is based on historical data, which shows that the stock market has always moved upwards over time, even recovering from all corrections and crashes in history. Let’s take a look at this chart:

Stock Market Values Overtime

Source: Inyova

Some people argue that they have special skills and expertise that enable them to increase their profits by buying and selling stocks all the time. Keen to prove once and for all that ‘buy and hold’ is the best approach, Buffett laid down a challenge in 2007:

He bet USD 500,000 that the S&P 500 (an index of major American companies) would outperform the average hedge fund performance over the following decade.

Guess who won?

When the bet finished in 2017, the hedge funds had increased by 2.2% each year on average. Meanwhile, Buffett had made a 7.1% annual gain through his ‘buy and hold’ approach.

Summary: Tips for investing small amounts

Let’s say you are looking for the best way to invest CHF 5,000 or a smaller amount. Here are the key points to keep in mind:

- Investing amount: Think about how much you want to invest. If you would like to invest small amounts, consider saving plans and automatic reinvestments.

- Risk profile: Think about how much risk you are comfortable with. Ideally, there should be a balance between the potential of growth and safe investments.

- Choose your stocks: Select your stocks according to your personal values and risk profile. Keep in mind that it is essential to have a well-diversified portfolio. (At Inyova, we take care of this for you!)

- Buy the stocks: Buy the stocks of your choice. Pay close attention to transaction costs and hidden fees!

- Hold: You are now in a great position for long-term growth of your investment.

How can I invest in the stock market?

At Inyova, we provide a way to invest small amounts of money in diversified stock portfolios. The first step is to get your personalised impact investing strategy on our website. You’ll see the list of stocks we recommend you buy, based on your interests and values. This service is completely free of charge and obligation.

If you decide to move ahead with your investment, our all-inclusive fee is between 0.6% and 1.2%, depending on the total balance in your account. If you have any questions, please feel free to contact our friendly team at any time. We are here to help.

Enjoy!