Investing in the future of your children early has never been more critical than today. However, when it comes to money investments for children, financial profit is no longer the only important factor. The global climate crisis proves that we have to set the right course now to guarantee a secure and fair future for the next generations. Financial investments are one of the most robust tools to influence politics and business positively.

But if you want to invest in a better world for your children, there are a few things to consider. For example, if you have money to invest for your children, a highly diversified investment strategy is fundamental, as is having a long-term mindset.

In this guide, we’ll explain how you can invest in a better future for your children with Inyova.

Why is investing money for children so important?

Our world and society are changing faster and becoming more unpredictable every day. Yesterday’s global players are meaningless today, and recently ridiculed start-ups are stirring up the corporate world. Tesla is a great example — a few years ago, the company was frowned at for its purely electrical approach, but today it’s one of the most valuable car manufacturers in the world.

It’s never been as crucial as today to start investing money for children as soon as possible. After all, even a small amount can yield high returns over a long period of time.

The sustainability factor: why impact investing is important

Given the uncertain future of the Swiss labour market and the global economy in general, it’s essential to consider investing money for children wisely and correctly. However, profit is no longer the only decisive factor when it comes to investing money for children. A financial gain is worth very little if we don’t leave our children a future worth living, and much will have to change to achieve this. The current global climate crisis proves that we must seize the chance for a profound change now. But significant social injustices, such as the discrimination of women or the payment of starvation wages in developing countries, also pose notable challenges for our society. Leave these problems unaddressed, and there will continue to be new political and social distortions in the future.

Impact investing is one of the most powerful tools when it comes to exerting a positive influence on politics and the economy. After all, as an investor in a company, you help determine the direction in which a company should develop. Furthermore, when investing money for your children in such a way, you also support companies in achieving worthwhile goals, such as providing drinkable water in the poorest countries, creating vegetable-based meat alternatives, or promoting the use of renewable energies.Your children’s money investment: how to do it

It’s important not to treat investing as a way of “getting rich overnight”. Analyses of the stock market over the last few decades have shown that investments in shares and bonds yield the best results over a long period, as the relationship between investment and possible loss is too unbalanced in short-term investments.

It’s also essential to spread your investment in different dimensions such as asset types, countries, and currency, because the more diversified your investments are, the lower the risk of incurring substantial losses.

The right partner for investing money for your children

At Inyova, all investment strategies are designed for long-term investments with diversified portfolios. Although this is considered to be the best way to achieve returns in the long run, it should be noted that no investment is without risk — there’s always a possibility of losing money.

Still, the key phrase is ‘long-term’, which is why we created Inyova for Kids, in reaction to popular demand from our impact investors. (As mentioned in other articles, the earlier you start investing, the better). In addition to Inyova’s commitment to ensuring that all companies in a portfolio are in line with the objectives of our impact investors, when it came to investments for children, several core themes were important to us:

- No hidden costs. Unlike other providers, Inyova has only one all-inclusive fee, which is easy to understand. This means that we don’t charge for changes to your portfolio, for withdrawing money, or anything else. The fees for an Inyova for Kids account are exactly the same as for an Inyova Invest account. Please note that fees are calculated based on the overall account value (Inyova Invest, Inyova for Kids and Inyova 3a combined), so the more money you invest in your various accounts the more likely you are to reach a new lower level of fees.

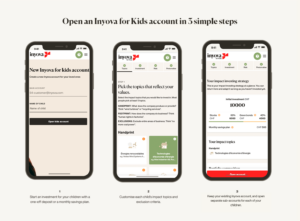

- An individual strategy for each of your children. If you already have an Inyova account, you can easily open a separate Inyova for Kids account with a fully personalised, dedicated investment strategy. You can customise each child’s impact topics and exclusion criteria, make adjustments, or withdraw at any time. The account will run in your name.

- Long-term impact investment, ideal for the next generation. Our investment approach is designed to yield the best results over a long investment horizon. This makes it an ideal way to save money for your child’s future.

- A great introduction to sustainability and investing. Best of all, you’ll be supporting companies that are working towards creating a more sustainable and responsible world for the next generation. Investing with Inyova is a fun way to introduce your children to both sustainability and investing!

- An easy process. To get started with impactful investing for your children, simply log in to Inyova, click on ‘Open Inyova for Kids account’ in the top right menu, and follow the process.

Want more information about Inyova for Kids? Read our FAQ page on the topic here.

Investing money for children: the sustainable way

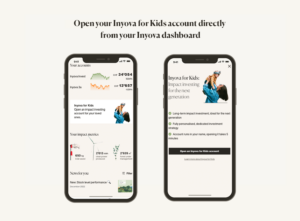

Investing money for your children in a sustainable way is easy and uncomplicated with Inyova. With a one-off deposit or a savings plan, you can start impact investing for the next generation. If you already have an account with Inyova, you don’t need to create a new account for your child’s portfolio; you can easily add different sub-accounts to your account.

Your children’s portfolio is entirely independent of your investment, so your account remains straightforward and easy to manage. You can set themes, exclusion criteria and risk levels for your children, all from your account.