Need a compelling reason to invest your money somewhere other than your bank account? You don’t need to look further than your bank account itself.

Cast your eyes to the interest rate assigned to your account. If your savings are sitting in any major Swiss bank, this number will be hovering somewhere around 0.01 %. The worldwide trend of lower and lower interest rates has become a standard commercial business in the banking industry. Since almost all central banks are using a strategy of low rates to push consumption there is no end of sight to minimal interest rates on your savings account.

This is bad news if you have deposited your money on a savings account for a better future. Let’s calculate, as an example. Let’s say you have a savings account with the typical Swiss interest rate of 0.01 %. That means your balance will increase by just CHF 1 per year on a CHF 10,000 balance. In five years, your wealth will have grown to the great heights of CHF 10,005.

Unfortunately for your savings goals, that’s the best-case scenario. In the last years, banks established new business practice in the industry – negative rates. It means that the bank is deducting a certain amount of your money yearly for you to deposit – instead of you getting interest for depositing your money on the savings account. In this case, you are reducing your savings gradually by leaving them in your bank account.

Added to that, inflation is now on an upward swing in Switzerland, meaning the price of goods and services is slowly increasing (for instance, in 200 a BigMac cost CHF 5.90. Now it costs CHF 6.50). Let’s assume inflation holds steady at today’s rate of 0.7 percent per year. What effect would this have on the real value of your money?

In five years time, you might need CHF 10,350 to buy what you could have bought with CHF 10,000 today. Meanwhile, your bank account will have only grown to CHF 10,005 – making you poorer than when you deposited your savings.

So, what’s the alternative to a bank savings account?

For those ready to take a longer-term view, the stock market has historically provided around 6 percent annual return – or around 4.6 percent when you subtract the effects of inflation.

By the way, you can create your own impact investing strategy here (free and without obligation).

Of course, historical returns don’t predict what could happen in the future – the opportunity for greater returns always comes with greater risk. It’s important that you go into any stock market investment with a full understanding that you could potentially lose money.

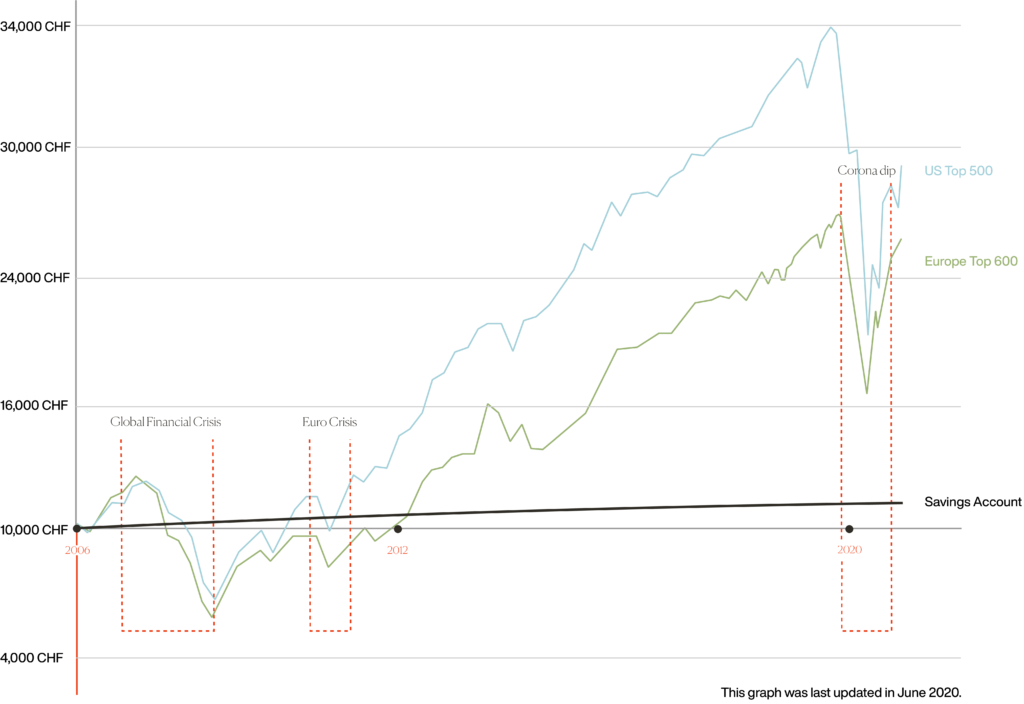

Let’s take a look at this chart:

Stock market performance 2006-2020

Here, you can see the markets took a major hit during the Global Financial Crisis. This lasted from 2007 until around 2009 when the markets started to rebound. Shorter-term investors who withdrew money from the world’s stock markets between 2007 and 2009 are likely to have suffered steep losses.

On the other hand, investors who were able to ride out the storm for a few years would now be making strong gains once again.

The coronavirus crisis proved once again that the stock market requires long-term planning to be successful. Although the international stock market was falling at the beginning of the pandemic it had already recovered by May 2020. If you want to know more about the best ways to invest during the corona crisis, take a look at this Inyova article.

This is one of the key reasons why it’s important to take a long-term view of any investment in the stock market. The last thing you want to do is panic and sell your shares in a bad market.

What’s the lower risk investment option?

For those who want an investment that’s less prone to market fluctuations, there are other options. One of them is ‘fixed-income securities’, which includes things like bonds.

Countries and large organisations use bonds as a way of borrowing money. Generally speaking, both are pretty good at paying the money back on time, along with a pre-determined interest rate. These types of investments provide lower returns than the stock market but are also considered safer because they are less volatile.

Take, for example, a 3 percent fixed-rate bond that’s based on a 5-year term. A CHF 10,000 investment in these bonds will result in an annual CHF 300 payment until maturity, when the investor will also receive the original CHF 10,000 back… a tidy CHF 1,500 gain by the end of the investment period.

Can I combine bonds and stocks into one investment?

With Inyova, your customised portfolio strategy can be based purely on stocks, or it can include a mix of stocks and government bonds. We adjust the ratio of stocks and bonds to create a portfolio that works for your financial situation and your personal preferences. Regardless, we will mitigate your risk by diversifying your investment across companies in different industries, company sizes, countries, and more – find out how we do that here.

Sounds great, how do I get started?

The first step is to get your personalised impact investing strategy – it’s free and non-binding. Using our easy online tool, you pick investment themes based on your personal values and interests. We show you exactly what stocks you can invest in.From there, our team will create a personalised investment strategy for you to consider. This is completely free & non-binding.

Get your free impact investing strategy here.

If you have any questions or suggestions about alternatives to a savings account you can always contact our team. We look forward to hearing from you!