Coronavirus (COVID-19) has been dominating the news recently, and you may be worried that this has ruined your plans to invest.

It’s worth noting that, since the stock markets started falling on February 24, hundreds of brand new customers have started investing with Inyova. Many existing Inyova customers have added to their investments too!

Wait, what?! Isn’t it a bad time to invest?

Here’s the thing: when stock market prices drop, it’s possible to buy more stocks at lower prices.

For investors who want to grow their wealth in the long-term, dips in the market present an opportunity: Because many, many decades of financial history illustrate that the markets have trended upwards in the long-term, despite these turbulences along the way.

With that in mind, there are two common approaches for investing in market downturns:

- Invest a lump sum all at once

- Invest small amounts over time

We’ll explain the pros and cons for both options in this article.

But maybe you’re thinking: I’m going to wait until the market starts to swing upwards, then I’ll start.

We will unpack this approach too.

But first, let’s take a quick look at what’s been happening in the stock market since Coronavirus (COVID-19) started to spread.

What effect has Coronavirus had on stock market investments?

Since early 2020, a novel coronavirus has spread around the globe, starting in China, then Europe and now the USA. Many countries introduced restrictions on the activities of their citizens, which severely impacted business activities. As a result, the financial markets started anticipating a negative impact on the global economy, and the value of most publicly listed companies went down.

On a positive note, politicians and central banks around the world also unveiled plans to stimulate their economies and help the stock markets recover. Known as ‘fiscal stimulus packages’, these plans included wage subsidies, tax breaks and loans for businesses, and even ‘free money’ for some individuals.

When thinking about the relationship between stock markets and wider societal issues (such as the outbreak of COVID-19), there are two important notes to keep in mind:

- Stock markets are “forward-looking”. This means prices already reflect the potential economic effects people think the virus will have in the future. This is another reason why the stock market often moves up and down in times of crisis – such movements reflect the fact that investors are reacting to promising and not-so-promising news (more about this shortly).

- Dips in the stock market are normal, especially in response to major global events. When we design any Inyova investment, we do so with the knowledge that rough market times will come at some time, for some reason. Such events have happened before, and they will happen again in the future. That’s why every investment made through Inyova is designed to withstand volatility in the long run.

Now let’s look at 3 common strategies for investing during market downturns.

Investment Strategy #1: Invest a lump sum all at once

This investment strategy is worth considering if you have a very long time horizon (say, 10-20 years) and are therefore not concerned that the market is changing a lot right now, since you are confident it will return to normal in time.

The advantage of this investment strategy is that you are well positioned if the market rebounds. With 100% of your investment amount already locked into the stock market, you will reap the full benefits when the market swings upwards again. Historically, this has been the most successful strategy for investing on average.

The downside? There’s always a chance the market could go down further in the short term. That’s why we always recommend going into a stock market investment with a long-term view. After all, many studies support the idea that “time in the market is more important than market timing” – in other words, the amount of time you hold your investment for typically has more impact on your returns, compared with entering the market at the “perfect” time.

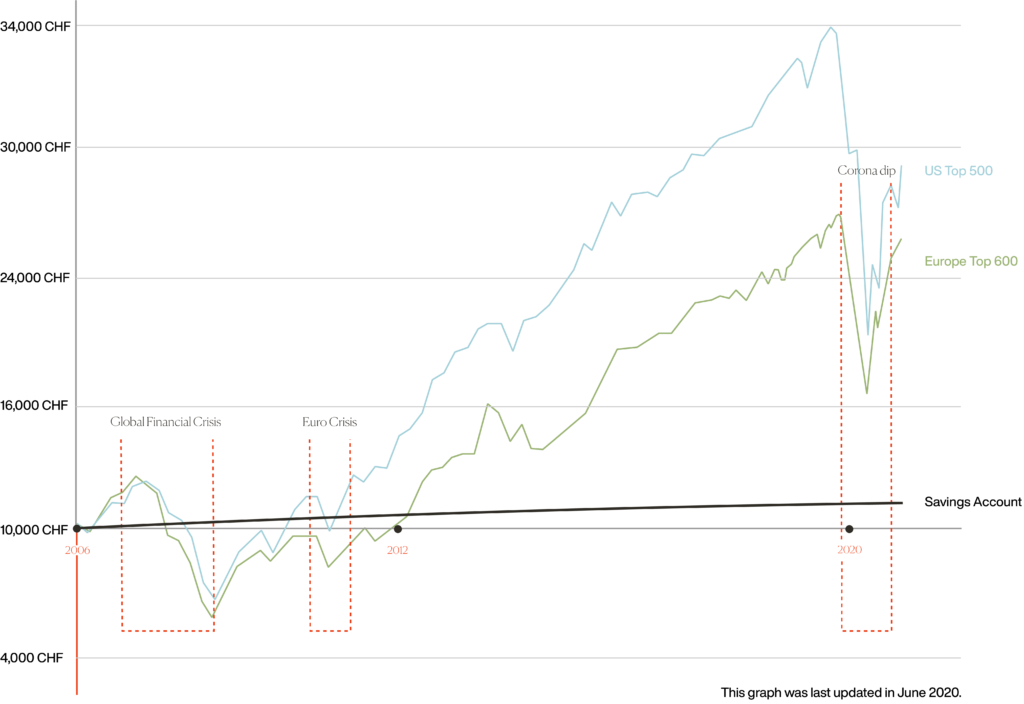

As an extreme example, let’s look at the Global Financial Crisis that started in 2008. A person who invested in Swiss equities at the market peak, directly before the crash wiped off around 34 percent its value within a year. Ouch!

The good news is, as early as 2014, these losses would have more than balanced. That’s right: despite enduring one of the biggest financial crises in history and the euro crisis in 2011, this worst-case investment would still have yielded a small positive return by 2014.

The trick is being comfortable with holding on and riding out any storm that comes along. You may have to wait a few years for a storm to pass, but in the end, the investment is almost always worthwhile.

Stock Market Performance 2006-2020

However, if you are still hesitating, this strategy might not be for you. Instead, have a look at Investment Strategy #2….

Investment Strategy #2: Invest small amounts over time

Many people recognise that market dips are an opportunity to invest – after all, you buy more stocks at lower prices.

However, investing everything at once can be emotionally taxing, especially if your time horizon is more medium-term. After all, in times of crisis, no one can predict what the markets will do next. As a result, many would-be investors find themselves stuck in “analysis paralysis”, never taking any action because they are always waiting for that perfect time to come along.

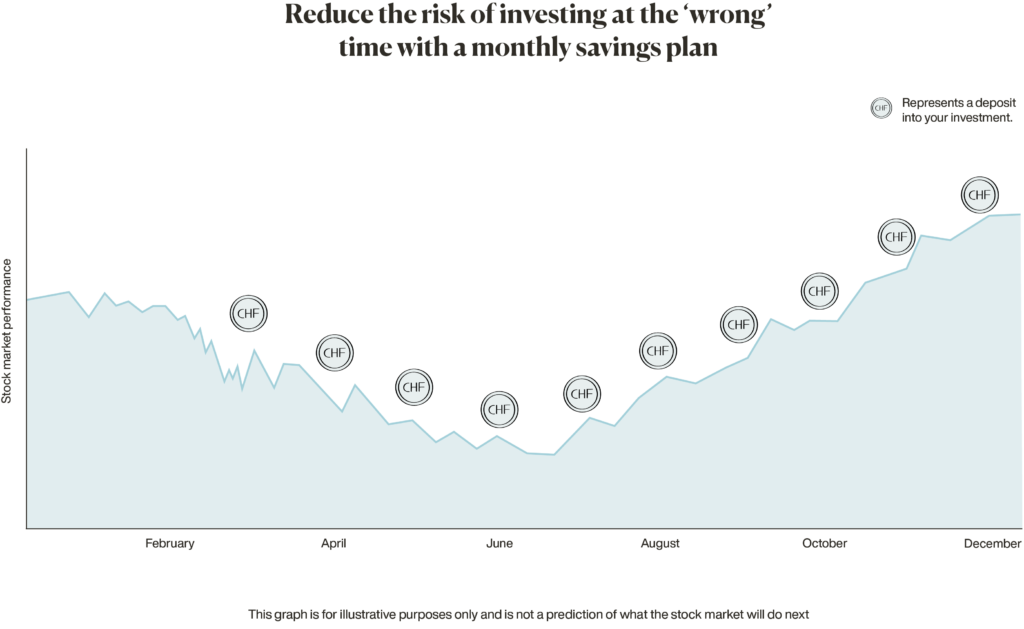

For investors who are feeling nervous about diving into a fast-changing market, this strategy makes a lot of sense: rather than buying all your stocks in one go, set up an automatic transfer where you add smaller amounts to your investment over time. It’s a great way to break through that dreaded paralysis!

How could this look like?

- On one end of the spectrum, you split your investment in 2 tranches and spread them out. For example, you could invest your first tranche now, and the second in 6 months.

- Alternatively, set up an investment savings plan where you add to your investment every month. This could result in as many as 10-20 tranches (although many investors keep their investment savings plan running continuously).

These methods of investing are popular because when you add money to your investment at different times, you end up buying stocks at a variety of prices. This reduces the risk that you buy at a “bad” time. In the end, you typically achieve something closer to the average stock market prices for the period.

Historically, this approach to investing has resulted in slower, steadier growth in the long-term on average (that means: less total growth, but fewer ‘ups’ and ‘downs’ along the way).

How exactly does an investment savings plan work?

With Inyova, it’s easy to get started.

Step 1: Personalise your impact investing strategy using Inyova’s online investment tool.

Step 2: Adjust your risk level until you are comfortable.

Step 3:

- For an investment in 2–3 tranches, reach out to our team. We’re happy to consult you on the details.

- For a monthly investment, simply set up a standing order to automatically add money to your investment account each month.

Step 4: Sit back and relax – we take care of buying your stocks each month and managing your investment.

Good to know: Inyova charges no additional fees when you opt for a savings plan or add more money to your investment. You can also suspend your deposits at any time, stop them completely or simply adjust the amount. As always, it’s possible to withdraw your money at any time – there’s no lock-in!

Investment Strategy #3: Wait until the market is at its lowest point, then start

We all know someone who has grand plans to sit on the sideline until the market bottoms out and then invest. And we get it: Buying right before the market starts to grow seems like a great way to start.

Unfortunately, timing the market is easy on paper but very difficult in practice. Investors who follow this approach often end up paralysed by the decision and, as a result, miss out on the strongest gains.

If you might fall into this category, it’s worth keeping in these two points in mind:

- In terms of generating long-term returns, it has proven worse to miss the stock market’s upward swing, than to experience downward movements along the way. As the saying goes: You have to be in it, to win it!

- The sting of a downturn is only felt if you are forced to sell your stocks in a hurry.

At Inyova, we do not recommend Investment Strategy #3. It’s not feasible for normal investors. You have to follow the markets closely and analyse a lot of data to hit the right timing. Most professionals regularly fail and need many tries to achieve one example of “good timing”.

So, why do people sell stocks when the market drops?

It’s an interesting psychological phenomenon: Humans take comfort in moving with the crowd.

When everyone is buying, there’s a “fear of missing out” that drives more and more people to buy. Since the stock market is driven by supply and demand, this pushes stock prices up.

Likewise, nervous whispers can send investors into a fear-driven selling frenzy.

As an investor, it’s important to be conscious about fear or nervousness guiding your decision-making (the same goes if you are excited or feeling the fear of missing out on something great). These emotional decisions often lead people to buy high and sell low. Obviously, that’s not a successful approach to investing!

If you have any questions about getting started, or the market in general, you can reach our friendly customer success team by emailing [email protected] or calling 044 271 5000.